Latest News

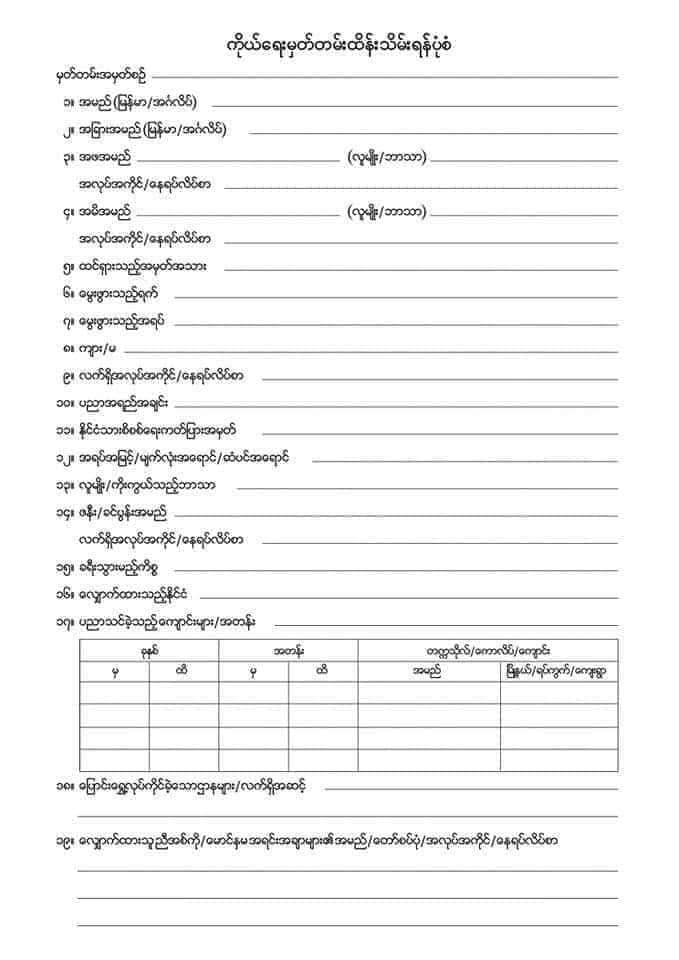

ကိုယ်ရေးမှတ်တမ်း ထိန်းသိမ်းရန် ပုံစံ

24.5.2023

23.5.2023

9.5.2023

- ***( Booking Appointment Letter Qr Code ၃ စုံ

- ကိုယ်ရေးထိန်းသိမ်းပုံစံ ၁ စုံ

- အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ ၂ စောင်

- မှတ်ပုံတင် မူရင်း + မိတ္တူ ၂ စောင် )***

- အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ ၂ စောင်

- မှတ်ပုံတင် မူရင်း + မိတ္တူ ၂ စောင်

- ကလေးကို အဖေဖြစ်ဖြစ် အမေဖြစ်ဖြစ် မိဘတစ်ယောက်ပါတဲ့ အိမ်ထောင်စုစာရင်း ထဲထည့်ထားရမယ်

- အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ ၂ စောင်

- မွေးစာရင်း မူရင်း + မိတ္တူ ၂ စောင်

- မိဘအုပ်ထိန်းသူတစ်ယောက်နဲ့ မိဘ ၂ ယောက်ရဲ့ မှတ်ပုံတင် မိတ္တူ ၂ စောင်

- အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ ၂ စောင်

- ၁၀ နှစ်ပြည့်မှတ်ပုံတင် မူရင်း + မိတ္တူ ၂ စောင်

- ၁၈ နှစ်အောက်ဖြစ်လို့ မိဘအုပ်ထိန်းသူတစ်ယောက် (သို့) အိမ်ထောင်စုစာရင်းထဲမှာပါတဲ့သူတစ်ယောက် နဲ့ မိဘ ၂ ယောက် ရဲ့ မှတ်ပုံတင် မိတ္တူ ၂ စောင်

- စာအုပ်အဟောင်း + PP မှာမိမိဓါတ်ပုံပါတဲ့စာမျက်နှာ မိတ္တူ ၂ စောင်

- Labour Card လိုပါတယ် Labour Card ကို နီးစပ်ရာမြို့နယ် အလုပ်သမားဦးစီးဌာနမှာ ပြည်ပအတွက်လို့ပြောပီ လျှောက်ထား လို့ရပါတယ် ၅၀၀ (သို့) ၁၀၀၀ ကျပ် labour card လုပ်လို့ရတဲ့ မြို့နယ်တွေကို Group ထိပ်ဆုံးမှာ Pin Post လုပ်ပေးထားတာရှိပါတယ် ရှာဖတ်ကြည့်ပါ

- သက်ဆိုင်ရာကျောင်းခေါ်စာ မူရင်း + မိတ္တူ ၁ စောင်

- ပြည်တွင်းရေကြောင်းမှ အခြေခံပင်လယ်ပြင် အသက်အန္တရာယ် လုံခြုံမှုသင်တန်းဆင်း လက်မှတ် မူရင်းနှင့် မိတ္တူ(၂)စုံ

- သက်တမ်းတိုးဖြစ်ပါက မြန်မာနိုင်ငံကူးလက်မှတ်စာအုပ်ဟောင်း၊ သင်္ဘောသားလုပ်သက် မှတ်တမ်း(CDC)စာအုပ် မူရင်းနှင့် မိတ္တူ(၂)စုံ

- နိုင်ငံခြားသားမှီခိုဖြစ်ပါက အပြန်စရိတ်ပေးသွင်းပီးကြောင်း ထောက်ခံစာ

- လက်ထက်စာချုပ်ကဲ့သို့သော အထောက်အထားများ

- နာမည် English စာလုံးပေါင်း

- မွေးသက္ကရာဇ်

- PV /PJ

- Male & Female

- မွေးဖွားရာဒေသ တွေကအရေးကြီးဆုံးပါ

6.5.2023

- Qr Code အဟောင်း

- Passport စာအုပ် + ဓါတ်ပုံပါတဲ့စာမျက်နှာ မိတ္တူ

- အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ

- မှတ်ပုံတင် မူရင်း + မိတ္တူ

- PJ ဆို လေဘာကဒ်

- PE ပြောင်းမယ်ဆိုကျောင်းခေါ်စာမူရင်း

29.4.2023

ကိုယ့်ကို အမေးများပြီး အများစု စာအုပ်မရကြပဲ Blacklist ထိတဲ့ ကိစ္စလေး မျှဝေပေးပါမယ်။

Passport စာအုပ် ဘယ် Type ပဲလျှောက်ထားဖူးပြီး စာအုပ်သက်တမ်းကုန်တာ ဘယ်နှစ်နှစ်ရှိရှိ နောက်တစ်ခါ ပတ်စ်ပို့ လျှောက်တဲ့အခါ သက်တမ်းတိုးနဲ့ပဲအကျုံးဝင်တာပါ။

ဥပမာ မမြလွင်က ပထမအကြိမ် PP လုပ်တုန်းက PJ စာအုပ်သက်တမ်းကုန်တာက ကြာပြီပဲထား ကြားထဲနိုင်ငံခြားမထွက်ဖြစ်လို့ စာအုပ်ကိုမေ့လောက်ရှိထားတယ် နောက်လိုအပ်လာချိန်မှာ Passport PV လုပ်မယ် ဆိုလည်း အသစ်လျှောက်တာမဟုတ်ပါဘူးနော် သက်တမ်းတိုးတာပါ ဖောင်ထဲက အမှတ်စဉ် ၂၆ မှာဖြည့်ကိုဖြည့်ရပါမယ်။

ငါကတော့ PJ ပဲလုပ်ဖူးတာ ခုပြန်လုပ်ရင် PV မို့ အသစ်ပဲဆိုရင် အဲ့ဒါမှားပါတယ်။ပြောရရင် လူတစ်ယောက်က Passport ကို တစ်ကြိမ်လျှောက်ဖူးပြီးရင် နောက်ပိုင်း Passport စာအုပ် Type change တာဆိုရင်တောင် သက်တမ်းတိုးသဘောပဲလုပ်ရမှာပါ။

အသစ်လျှောက်တယ်ဆိုပြီး နဂို စာအုပ်အဟောင်း မပြရင် လိမ်လျှောက်တာဖြစ်ပြီး Blacklist ထိပါတယ်နော်။သတိပြုကြပါ။ လက်ထဲကစာအုပ်ပျောက်ရင်လည်းပျောက်ဆုံးပဲလျှောက်ရမှာပါနော်။

Crd : Thinn Thinn ;

27.4.2023

Passport လျှောက်ရင် ဟိုသွားဒီသွားဖြစ်နေမှာစိုးလို့ ပုံလေးတင်ပေးထားပါတယ်…

နေရာမှား၀င်ရင် အစကနေပြန်တန်းစီရတာလူပင်ပန်းလို့ပါ။ အထူးသဖြင့် သွေးနှောများ…

ခု Systemရဲ့ ကောင်းတဲ့ အချက်က အရင်ကထက်တော်တော် ပိုမြန်သွားတယ်။Online booking မှာ နဲနဲ အလုပ်ရှုပ်ပေမယ့် တကယ်သွားလုပ်တော့ တော်တော် အချိန်ကုန် လူပင်ပန်းသက်သာသွားတယ် ။

အချိန်တွေကို အသုတ်လိုက်ဘဲ ၀င်ခ့င့်ပြုတော့ ကိုယ့်ရထားတဲ့ အချိန် မှ လာတာ ပို သက်သာပါတယ် မဟုတ်ရင်အပြင်နေပူထဲမှာ တိုင်ပတ်တယ်။အပြင်မှာ လဲ လူစုမနေတော့ဘူးပေါ့ .ခွင့်သမားဆို နေ့၀က်လောက်ယူရင်ကို ဘဲ အဆင်ပြေပြီ

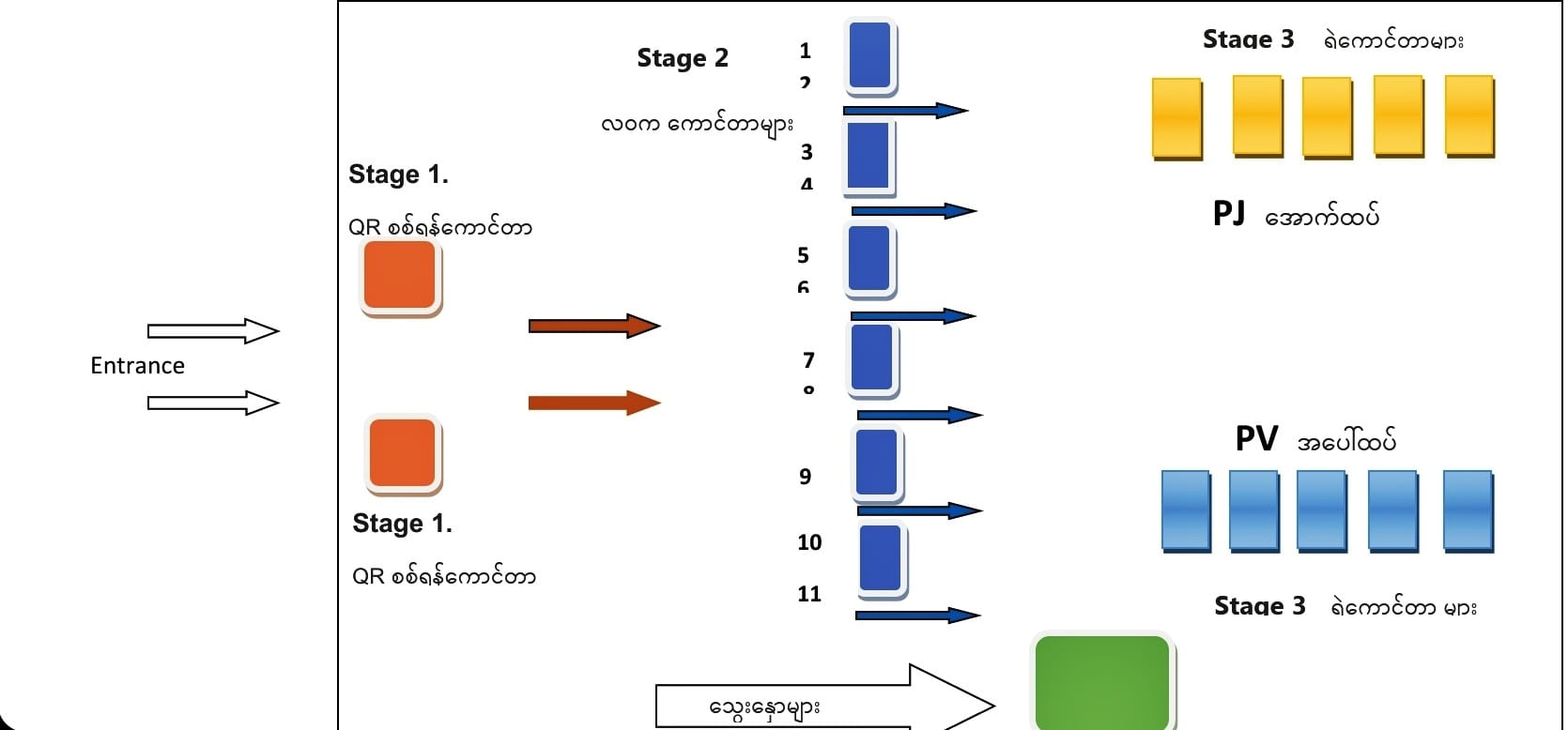

Stage သုံးဆင့်ဘဲဖြတ်ရပါတယ်။

![]() Stage 1.Entrance မှာ QR စစ်ပါတယ် ။

Stage 1.Entrance မှာ QR စစ်ပါတယ် ။

QR သုံးစုံလိုပါတယ် ။QRတစ်စုံကို ယူထားပါတယ် မှတ်ပုံတင်နဲ့ scan ဖတ်ပြီး တိုက်စစ်ပါတယ် ။QR reader မှာ ပြတဲ့ information နဲ့ ကွဲလွဲ နေရင် ပေးမ၀င်ပါဘူး။ထို့ကြောင့် ပွဲစားဆီက QR ၀ယ်ရန်စိတ်မကူးပါနှင့်.။ Print ထုတ်ထားတဲ့ စာရွက်မှာ Scan ဖတ်မရရင် , Ph ထဲက QR screen shotကို ပြပါ။ Ph ထဲက Qr က scanဖတ်လို့ ပို အဆင်ပြေပါတယ်)

![]() Stage 2 .Immigration counter မှာ အစစ်ဆေးခံ

Stage 2 .Immigration counter မှာ အစစ်ဆေးခံ

a.QRform 2စုံ

b.ကိုယ်ရေးအချက်အလက်ဖောင် -1 စုံ

c.NRC မူရင်း နဲ့ NRC Copy -2 စုံ

d. အိမ်ထောင်စုမူရင်း နဲ့ အိမ်ထောင် စု Copy 2စုံ

e.Pssport အဟောင်း Copy 2 စုံ

Counter မှာတင်ပြရပါတယ်

လ၀က အရာရှိ မှ တင်ပြထားသောDocumentsများကို စစ်ဆေးပြီးကြောင်း တုံးထု ပေးပါတယ် ။ Counter 10 ,11 က စစ်တာပိုမြန်ပါတယ် သိပ်မရစ်ပါဘူး ။ passport ထဲမှာ ထည့်မယ့်Information ေလာက်ဘဲ confirmပါတယ် ။မလိုတာတွေလျှောက်မမေးပါဘူး ။ 3 mins လောက်ဘဲကြာပါတယ် ။

![]() သွေးနှောများကတော့ အစိမ်းပြထားတဲ့ လ၀က အရာရှိ အခန်းထဲ၀င်ပြီးအစစ်ခံရပါတယ်.ကောင်တာ ၁၁ခု မှာတန်း မစီရပါဘူး..

သွေးနှောများကတော့ အစိမ်းပြထားတဲ့ လ၀က အရာရှိ အခန်းထဲ၀င်ပြီးအစစ်ခံရပါတယ်.ကောင်တာ ၁၁ခု မှာတန်း မစီရပါဘူး..

![]() Stage 3. Police counter မှာ မျက်လုံး ,လက်ဗွေ Scanဖတ် ,Photo ရိုက်

Stage 3. Police counter မှာ မျက်လုံး ,လက်ဗွေ Scanဖတ် ,Photo ရိုက်

PV ဆို အပေါ်ထပ် , PJ ဆို အောက်ထပ်ပါ ။ လ၀ကမှ တံုးထု ပေးလိုက်သော စာရွက်များ ,နဲ့ NRC မူရင်း ,အိမ်ေထာင်စုမူရင်း ,Old Passport မူရင်းက်ု police counter မှာ အပ်ပါ ။ လက်ဗွေ ယူ မျက်လုံးScan ဖတ် Photo ရိုက်ပါတယ် ။ ဆရာ၀န်တွေ Engineer တွေဆို ခံ၀န်ထိုးရပါတယ် ။ Old passport ကို တော့ Police counter က သိမ်းပါတယ် ။သက်တမ်းတိုးဆို Signထပ်ထိုးစရာမလိုပါဘူး ..အရင်Sign ကို ပြန်သုံးပါတယ်။ NRC မူရင်း .အိမ်ထောင်စုမူရင်းနဲ့ Slip ပြန်ယူလာဖို့မေမ့ပါနဲ့

ပြီးရင် Slip ရပါပြီ .နောက်ဆယ်ရက်ကြာရင် သွားထုတ်ရပါမယ် ။

Ps. Copy ကူးတာ က ရံုးအပြင်ကဆိုင်တွေမှာ အပြီးအစီးလုပ်သွားဗျ အထဲမှာ copy ကူးလို့မရလို့ပါ.တန်းစီတဲ့ လမ်းကြားလေးထဲမှာ Copyဆိုင်တွေရှိပါတယ်..

Interview မေးလို့ တစ်နိုင်ငံလုံးက Passport ရုံးတေွေမွှော Online booking ပေးဖို့ Suggestion ပေးခဲ့ပါတယ်။

Crd : Oakker Hein ;

26.4.2023

25.4.2023

24.4.2023

20.4.2023

အသက်ခြောက်ဆယ်ကျော်မိဘတွေ နဲ့အတူတူ passport လုပ်ခဲ့တဲ့အတွေ့ကြုံလေးပြောပြချင်လို့ပါ။

နောက် ၁၀ ရက်ကြာမှလာထုတ်ရုံပဲ။ ထုတ်ရင်လည်း ကိုယ်စားထုတ်ပေးလို့ရတယ်။ မှတ်ပုံတင် သန်းခေါင်စာရင်းလိုရမယ်ရယူသွားပေါ့နော်။

Crd : Yu Yu ;

19.4.2023

Passport လုပ်မည့်သူများအမျိုးအစားကိုအရွေးမမှားရအောင် –

၁။ အလည်သက်သက်၊ ဘုရားဖူး၊ ဆေးကုဖို့သွားရင် PV လျှောက်သွားပါ။

၂။ ကျောင်းတက်ဖို့သွားမယ်ဆို ကျောင်းဝင်ခွင့်ရပြီးမှဆိုရင် PE လျှောက်သွားပါ။ ကျောင်းဝင်ခွင့်မရမီ လျှောက်ရမယ်ဆို PV လျှောက်ပြီး PV နဲ့ထွက်လို့ရတယ်။ လေဆိပ်မှာ လဝက ကရစ်ရင် ၅ သောင်းလောက်ရေလောင်းရင်ရတယ်။

၃။ အလုပ်လုပ်ဖို့ဆိုရင်တော့ သွားလုပ်မဲ့နိုင်ငံ၊ လစာရရှိမှု၊ ကိုယ်တိုင်လျှောက်တဲ့အလုပ် (သို့) လိုင်စင်ရ agency နဲ့လျှောက်တဲ့အလုပ်ဟုတ်မဟုတ်ပေါ်မှာမူတည်ပြီးလုပ်ရမယ်။

(က) ဘယ်နိုင်ငံဖြစ်ဖြစ် SGD 1200 နဲ့အထက်နဲ့ညီမျှတဲ့အခြေခံလစာရတဲ့အလုပ်ဆိုရင် PJ လျှောက်၊ ကိုယ်တိုင် OWIC အလုပ်သမားလမ်းညွှန်သင်တန်းတက်ဖို့လျှောက်၊ သင်တန်းဆင်းလက်မှတ်နဲ့ OWIC လျှောက်ပြီးထွက်လို့ရတယ်။

(ခ) လစာ SGD 1200 အောက်ဆိုရင်တော့ စလုံး၊ မကာအို၊အရှေ့အလယ်ပိုင်းနိုင်ငံများ၊PNG, ကိုကိုယ်တိုင်ရှာတဲ့အလုပ်အလုပ်နဲ့သွားမယ်ဆိုရင် PV လုပ်ပြီးထွက်သင့်တယ်။ လေဆိပ်မှာ လဝက ကရစ်ရင် ၅ သောင်းလောက်ရေလောင်းရင်ရတယ်။

(ဂ)လစာ SGD 1200အောက်တခြားနိုင်ငံတွေ ကိုယ်တိုင်ရှာတဲ့အလုပ်နဲ့သွားမယ်ဆိုရင် PJ လျှောက်၊ လိုင်စင်ရ agency နဲ့ချိတ်ပြီးသူတို့စီစဥ်ပေးမှ OWIC လျှောက်ပြီးမှထွက်လို့ရမယ်။

(ဃ) ဘယ်နိုင်ငံဖြစ်ဖြစ် SGD 1200 အောက်လစာရတဲ့အလုပ်ကို လိုင်စင်ရ agency ကရှာပေးပြီးစာချုပ်နဲ့သွားရမဲ့အလုပ်ဆိုရင် PJ လျှောက်ရမယ်။

Crd : Myanmar Pyithar ;

18.4.2023

6.4.2023

5.4.2023

dေန ့10 နာရီ pj သြားလုပ္ခဲ့တဲ့ အစအဆံုး

အတွေ့အကြုံ လေး ကို ညီမလိုပဲ မလုပ်ရသေးသူတွေအတွက် တစ်ဆင့်ချ င်းစီ

အသေအချာလေး ဝေမျှ ပေးမယ်နော်.

.ညမက 10 am ေပမဲ့

8 နာရီကတည်းက ရောက်နေတော့ အပြင်မှာ

1နာရီကျော်လောက် စောင့်ရပါတယ်

အဲ့နေရာ ခုံအသေးလေးတွေချထားတော့

ဝင္ထိုင္တာ ခံုခ 1000 ေပးရပါတယ္..

(မထိုင်လည်းရတယ်)

9 ခွဲမှာ အထဲ စ သွင်းတယ်.

1. အဲ့မှာ မှတ်ပုံတင် နဲ့ qr ပါတဲ့စာမျက်နှာ အဲ့နှစ်ခုကို

အရင်ပြရပါတယ်.

.(qrပါတဲ့ စာမျက်နှာမှာ အချိန်ကို စစ်ပါတယ်ရှင်

ညမ စာရွက်မှာ dateပဲ ပါပြီး time ပါမသွားတော့

phoneထဲက အချိန်ပါတဲ့ qrမူရင်းကို ပြန်ရှာပြနေရလို့

ညမအစောကြီး ထိပ်ဆုံးက ရောက်ပေမဲ့

ညမ နောက်က လူတွေအားလုံးကျော်တက်သွားလို့

တန်းစီတာ နည်းနည်းနောက်ကျ ကျန်ခဲ့ပါတယ်😁)

2.အဲ့မှာ အထဲဝင်ဖို့ ဝင်ခွင့်လည်ဆွဲကတ်ပြား ထုတ်ပေးပါတယ်..(အဲ့နေရာက စ ပြီး ယောကျာ်းလေးက တစ်တန်း

မိန်းခလေးက တစ်တန်း သီးခြားတန်းစီရတာပါ)

3.ဝင်ခွင့်ကတ်ရပြီး အဝင်ပေါက်

body checking စစ်တဲ့နေရာ နေရာမှာ

မှတ်ပုံတင် နဲ့qr စာရွက်ကိုပဲ ဆက်လက်ပြရပါတယ်.

4.အဲ့က နေ ဆက်ဝင်သွားတော့ လဝက ကောင်တာတွေဆီ ရောက်ပါတယ်..ညမက လူနည်းတဲ့ကောင်တာ

ဝင္စီလိုက္ပါတယ္.

အဲ့ရောက်မှ

သန်းခေါင်စာရင်းအစစ် နဲ့မိတ်တူ နှစ်စောင်

မှတ်ပုံတင် နဲ့မိတ်တူ နှစ်စောင်

ထုတ်ထားတဲ့ qr စာရွက် အဲ့3မျိ ု းကို ပေးရပါတယ်

ညမရှေ့က နှစ်ယောက်က သန်းခေါင်စာရင်းစုတ်ပြဲနေလို့အဲ့မှာ ငါးထောင်ပေးခဲ့ရပါတယ်

ညမက ညမအလှည့်မှာ သန်းခေါင်စာရင်းရစ်မှာစိုးလို့သဘောကောင်းပုံရှိတဲ့ ဘေးက အတန်းကို

ပြန်ပြောင်းပြီး တန်းစီလိုက်ပါတယ်

တျပားမွ မေပးခဲ့ရပါဘူး

အဲ့ကနေ မှာ သူတို့က မိတ်တူ တရွက်စီယူထားပီး

ကျ န်တရွက်စီ နဲ့ အစစ်တွေကို သူတို့အနောက်မှာရှိတဲ့ အနောက်ပေါက်လေးက ပြန်ပေးပါတယ်

စာရွက်တိုလေးတခုပါ ပါပါတယ်

5.အဲ့ကနေ အထဲဆက်ဝင်ရင်တော့ ဓာတ်ပုံရိုက်တဲ့

ကောင်တာတွေဆီ ရောက်ပါပြီ..

pvက အပေါ်ထပ် pjက အောက်ထပ်..

ညမက လူနည်းတဲ့ကောင်တာ18 ကို ရွေးတန်းစီလိုက်ပါတယ်..အဲ့မှာလိုအပ်တာက

စောနက လဝကက ပြန်ပေးလိုက်တဲ့ စာရွက်တွေရယ်

ကိုယ်ရေး မှတ်တမ်း တစုံရယ် pj မို့လေဘာကတ်ရယ်

ေပးရတာပါ..

(အဲ့ဓာတ်ပုံခန်းမှာလည်း သန်းခေါင်စာရင်းကို

ဆက်လက်စစ်ပါတယ် ပြဲနေစုတ်နေ ဖတ်မရတာတွေဆို နဲနဲရစ်တာပေါ့..ကိုယ့်သန်းခေါင်စာရင်းက

မကောင်းရင် ငါးထောင်လောက် အိပ်ကပ်ထဲ ဆောင်သွားပါ…ညမက အားလုံး စင်းလုံးချော ဘာမှပြောစရာမရှိတော့ qrစာမျက်နှာကို ရစ်ပါတယ်

qrပါတဲ့ စာမျက်နှာနောက်က နောက်ထပ်တရွက်ပါမသွားလို့အပြင်မှာ ပြန်ကူးမလားdမှာကူးပေးရမလား

မေးတော့….

dမွာပဲကူးမယ္ဆိုၿပီး ေငြ 2000 ေပးခဲ့ရတယ္..

အဲ့မှာစလစ်ရပြီး စလစ်ပါ အချက်အလက်တွေ

သေချာစစ် မှားရင်တခါတည်းပြန်ပြင်ခိုင်းခဲ့ပါ..

ပြီးရင် ပြန်လို့ရပါပြီ..1နာရီကျော်လောက်ကြာခဲ့ပါတယ်

ကိုယ်တန်းစီတာပေါါ် မူတည်ပြီး အချိန်ကြာ/မြန်ပါတယ်

ညီမတော့ လူနည်းတဲ့ကောင်တာရွေးစီခဲ့ပါတယ်..

ငွေ 10000 အိပ်ကပ်ထဲ ထည့်ဆောင်သွားပေမဲ့

2000 ပဲ ကုန်ခဲ့ပါတယ်

Crd : Wai Wai ;

4.4.2023

D နေ့ Passport လုပ်ခဲ့တဲ့အတွေ့ကြုံကိုမျှဝေချင်ပါတယ်မနက် 8Am_10Am သမားဆိုတော့ 7 Am အရောက်သွားလိုက်တယ်တန်းစီတဲ့ေနရာမှာထိုင်ခုံကတော့တစ်ခုံကို ၁၀၀၀ ပေးခဲ့ရတယ်မထိုင်လို့လည်းမရဘူးလေထိုင်ခုံကအတန်းရှည်ကြီးလိုက်ကိုစီထားတော့ထိုင်ရတော့တာပဲ။အဲဒါနဲ့ 7:30 Am မှာ၀င်ခွင့်ပေးတယ် ရုံးထဲကို မင်ဖျက်ဆေး၊ထီး၊ဦးထုပ် ဘာမှယူသွားလို့မရပါ၊ ယူသွားရင်လည်းအမှိုက်ပုံးထဲပဲထည့်ခဲ့ရမှာပါ။ရုံးထဲရောက်တာနဲ့ လ၀က ကောင်တာ (8 )ကိုတန်းစီခဲ့တယ် အားလုံးအဆင်ပြေပါတယ် ရစ်လည်းမရစ်ဘူး သဘောလည်းကောင်းတယ်။ဓာတ်ပုံရိုက်တဲ့နေရာမှာကတော့ (19) ကတော်တော်အဆင်ပြေခဲ့ပါတယ် ပြုံးပါ၊ရှင်းပြ ပါဆိုတဲ့ဆောင်ပုဒ်နဲ့ညီပါတယ် ။အဖေ၊အမေနာမည်ရှေ့မှာ ဦး၊ဒေါ်တွေထည့်ခဲ့ပေမယ့် ပိုက်ဆံတစ်ပြားမှမတောင်းပါဘူး ရစ်လည်းမရစ်ပါဘူး။ 10 Am မှာ စလစ်ရခဲ့ပါတယ်။နောက်ရက်သွားမယ့်သူတွေကတော့ ဦး၊ဒေါ် တွေကို ဘယ်သူ့နာမည်ရှေ့မှထည့်မသွားပါနဲ့။

- လိုအပ်တဲ့စာရွက်စားတမ်းကတော့

- မှတ်ပုံတင်မူရင်း/မိတ္တူ နှစ်စောင်

- သန်းခေါင်စာရင်းမူရင်း/မိတ္တူနှစ်စောင်

- Appointment Letter နှစ်စောင်

- ကိုယ်ရေးမှတ်တမ်းတစ်စောင်

- PJ ဆို Labour ကဒ် မူရင်း

Crd : Khant Chaw Ko Ko ;

31.3.2023

မနေ့က စလစ်သွားထုတ်တာ အလွဲများစွာနဲ့ အဆင်ပြေသွားလို့ ကြုံခဲ့တာလေး ပြန်ပြောပြချင်လို့ပါ။

QR ယူတုန်းက နာမည်မှာ “မ/Ma” ထည့်၊ အဖေ/အမေ နာမည်တွေမှာလည်း “ဦး/ ဒေါ်” ထည့်မိတဲ့ အပြင်၊ ပညာအရည်အချင်းမှာလည်း ဘွဲ့တွေ ရေးမိလို့၊ ပိုက်ဆံတွေ ဘယ်လောက်တောင် တောင်းလိုက်မလဲ ဆိုပြီး ကြောက်နေတာ။

စာရွက်စာတမ်းတွေဆိုလည်း လိုအပ်တာအကုန် အများကြီး ပိုယူသွားလိုက်တယ်။

မနေ့တုန်းက လဝက ဖြတ်ထဲက အဆင်မပြေတာ၊ လက်က လက်ဆီထွက်တာရော၊ အရေခွံ ကွာတာရောကြောင့် လက်ဗွေကို Scan ဖတ်မရလို့၊ ခဏခဏလုပ်ရပြီး၊ လုံးဝ လက်ဗွေ ယူလို့မရဘူး။

ဒါပေမယ့် အတော်လေး ကံကောင်းတယ်။ လဝက က မှတ်ချက် အနေနဲ့ ၂၀% ပဲရှိတယ်ဆိုတဲ့ စာနဲ့ လွှတ်ပေးလိုက်လို့၊ အပေါ်ထပ်ကို ရောက်ခဲ့တယ်။

အပေါ်ရောက်တော့ လက်ဗွေ မရတဲ့ အတွက် ညည်းက အသက်ဘယ်လောက်လဲ၊ အသက်ကြီးနေပြီလား၊ ၇၀/ ၈၀ကျော်အရွယ်မလို့ လက်ဗွေ မရတာလား၊ ဘာလားနဲ့ ပြောတော့၊ ကိုယ်လည်း ဟီးဟီး ဟီးဟီးနဲ့ လက်က အရေခွံလဲပြီး လက်ဆီတွေ ထွက်နေလို့၊ လက်ဗွေ အရာတွေ မရှိလို့ပါ ဆရာရယ်လို့ ပြောတော့၊ အေး ဒါဆို ညည်း အဘိုး/ အဖွား ကောင်တာကို သွားရမယ်ပြောရော။ ဟုတ် ဆရာလို့ ပြောလည်းပြီးရော၊ ဘွဲ့ကို တွေ့ပြီး၊ ညည်းက ပဲကြီးလှော်ဘာညာနဲ့၊ အစိုးရဝန်ထမ်းလုပ်ဖူးလား မေးပါတယ်။ မလုပ်ဖူးပါဘူး။

ဘွဲ့ရပြီးထဲက ဈေးပဲ ရောင်းတာပါ ဆရာလို့ ပြောတော့၊ခံဝန်ထိုးဖို့၊ ဌာနစု ၅ကို သွား၊ ခံဝန်စာရွက်မှာ လက်မှတ်ထိုး ဆိုပြီးလွှတ်ပါတယ်။ ကျန်တာတွေ အကုန်စစ်ပေးပြီးပြီ၊ လက်မှတ်ရတာနဲ့ ပြန်ဝင်ခဲ့၊ ပြီးရင် ညည်းက အသက်ကြီးတော့ အဖိုး/ အဖွားကောင်တာ သွားရမယ် ဆိုပြီး ရီကျဲကျဲနဲ့ပြောပါတယ်။

သူရီတိုင်း ကိုယ်လည်း ဟုတ် ဆရာ ဟုတ် ဆရာ နဲ့ ရီနေတာပါ။ ဌာနစု ၅ ရောက်တော့ ဒီဘွဲ့နဲ့ ဘာလို့ အလုပ်မလုပ်တာလဲ၊ အစိုးရဝန်ထမ်းကော ဘာလို့ မလျှောက်တာလဲ၊ ဘာလို့ ဈေးရောင်းတာလဲ၊ ဘာရောင်းတာလဲ မေးပါတယ်။

ဟုတ် ဆရာ၊ အဖေဆုံးသွားလို့၊ အမေ နဲ့ ညီမ က မှီခိုသူ ဖြစ်လို့၊ အရင်ထဲက ဈေးရောင်းလက်စမို့ ဈေးပဲ ဆက်ရောင်းလိုက်တာပါ။ ရောင်းတာက အချိုမှုန့်တို့ အဝတ်အထည်တို့ လမ်းထဲမှာ ရောင်းတာပါ ဆရာလို့ ပြောတော့၊ ဆရာက အေးအေး ရေးပြီး သွားသွား ဆိုပြီး၊ ပြောပါတယ် (ထပ်ကံကောင်းတာ ![]() )၊ အဲဒါနဲ့ ဓာတ်ပုံရိုက်ဖို့ တန်းစီနေတဲ့ အတန်းထဲ ပြန်လာပြီး၊ အထဲကို ဝင်ခွင့်ပြန်တောင်း၊ စာရွက်ပြန်ပြတော့၊ Pass ဖြစ်သွားပါတယ်။

)၊ အဲဒါနဲ့ ဓာတ်ပုံရိုက်ဖို့ တန်းစီနေတဲ့ အတန်းထဲ ပြန်လာပြီး၊ အထဲကို ဝင်ခွင့်ပြန်တောင်း၊ စာရွက်ပြန်ပြတော့၊ Pass ဖြစ်သွားပါတယ်။

ပုံရိုက်ဖို့ ရှေ့မှာ ၁ယောက်စောင့်ဦးဆိုလို့ စောင့်ရပါတယ်။ ကိုယ့်အလှည့် ပုံရိုက်ခါနီး၊ မျက်မှန်ချွတ်ဆိုတော့ ချွတ်လိုက်ပါတယ်။

မျက်မှန်ချွတ်ထားရတော့ အရှေ့က ပြောနေတဲ့ သူကို ဘာမှ မမြင်ပါဘူး ![]() အဲ့မှာ ထပ်ပြီး ရင်တုန်ရပါသေးတယ်။

အဲ့မှာ ထပ်ပြီး ရင်တုန်ရပါသေးတယ်။

ဆွဲကြိုးချွတ်ဆိုလို့၊ လည်ပင်းက ကတ်ပြားကို အရင် ချွတ်လိုက်ပါတယ်။ ပြီးတော့ ဘာတွေ ပြောနေမှန်း မကြားတာရော၊ မမြင်တာရောကြောင့်၊ ဘာလုပ်ရမှန်း မသိဖြစ်နေတုန်း ဘေးက လူတွေကို အားကိုးတကြီးနဲ့ ဆွဲကြိုးချွတ်ရတာလား ထပ်မေးကြည့်တော့၊ ဟုတ်တယ်တဲ့၊ အဲဒါနဲ့ ဆွဲကြိုးကို ချွတ်လိုက်ပါတယ်။ (မျက်မှန်မပါတော့ မမြင်မကန်းနဲ့ ချိတ်ဖြုတ်ရတာ ကြာနေတော့၊ ခုံက ထလာပြီး ဘာတွေလုပ်နေတာလဲ ပြောပါတယ် ![]() )

)

အဲ့မှာဆွဲကြိုးဖြုတ်နေတာ တွေ့တော့၊ ဟဲ့ ဆွဲထားတဲ့ကတ်ပြားကို ချွတ်ခိုင်းတာ၊ ညည်း ဆွဲကြိုးကို ချွတ်ခိုင်းတာ မဟုတ်ဘူး၊ ကျပျောက်မှ လျော်နေရဦးမယ် ဘာညာနဲ့ အော်ခံထိတော့မှ ဆွဲကြိုးကလည်း ဖြုတ်လို့ရတော့တယ်။

ရင်တုန်ပန်းတုန်နဲ့ ဆွဲကြိုးကလည်း ပြန်ဝတ်လို့ မရ။ ဆွဲကြိုးကို လက်ကကိုင်ပြီး၊ လက် ၁၀ချောင်းကို လက်ဗွေ Scan ထပ်ဖတ်ခိုင်းတော့၊ လက်ဆီတွေနဲ့ ၁ခါနဲ့ မရ၊ ၂ခါ/၃ခါ နဲ့လည်း မရနဲ့၊ ဘယ်လိုတွေ လုပ်နေတာလဲ ဘာညာ နည်းနည်းဟောက်လို့ လူက ကြောက်နေပြီ။

ရော့ တစ်သျှူးနဲ့ သုတ်ဆိုပြီး လှမ်းပေးတော့ လက်တွေသုတ်၊ စက်ကိုသုတ်နဲ့ ရပါစေ ဆုတောင်း ![]() နောက်ဆုံး ထပ်လုပ်မယ်၊ မရရင် အဖိုး/ အဖွား ကောင်တာမှာ သွားပြန်တန်းစီတဲ့။ နောက်ဆုံးခေါက်မှာ စိတ်ကို နည်းနည်း လျှော့ထားပြီး ၂ခါ ၃ခါ လုပ်ရင်း ရသွားပါတယ်။ ရပြီ သွားတော့၊ အပြင်မှာ စောင့်နေ၊ နာမည်ခေါ်မှ ဝင် ဆိုမှ သက်ပြင်းချရပါတယ်။ ထွက်ပြီး၊ အဝ ရှိသေး၊ နာမည်ခေါ်လို့ ပြန်ဝင်တော့၊ ဖောင်တင်တာ ဘယ်သူတင်တာလဲ မေးပါတယ်။

နောက်ဆုံး ထပ်လုပ်မယ်၊ မရရင် အဖိုး/ အဖွား ကောင်တာမှာ သွားပြန်တန်းစီတဲ့။ နောက်ဆုံးခေါက်မှာ စိတ်ကို နည်းနည်း လျှော့ထားပြီး ၂ခါ ၃ခါ လုပ်ရင်း ရသွားပါတယ်။ ရပြီ သွားတော့၊ အပြင်မှာ စောင့်နေ၊ နာမည်ခေါ်မှ ဝင် ဆိုမှ သက်ပြင်းချရပါတယ်။ ထွက်ပြီး၊ အဝ ရှိသေး၊ နာမည်ခေါ်လို့ ပြန်ဝင်တော့၊ ဖောင်တင်တာ ဘယ်သူတင်တာလဲ မေးပါတယ်။

ကိုယ်တိုင်ပါ ဆိုတော့ နာမည်ရှေ့မှာ ဦး၊ ကို၊ မောင်၊ မ တွေ ဘာလို့ ထည့်တာလဲ မသိဘူးလား၊ လိုက်ဖြုတ်နေရတယ်ဆိုပြီး ပြောပါတယ်။ ရှေ့မှာ အဆင်မပြေတာကြောင့် ကြောက်တဲ့ အရှိန် မပျယ်သေးခင်၊ ထပ်မေးတော့ မျက်လုံးကလည် ကလည်နဲ့ ငိုရတော့မှာလားပေါ့၊ ပြီးလည်း ပြီးရော စလစ်ကို ဘေးကရဲကို လှမ်းပေး၊ အသက်ကြီးနေပြီဆိုတော့ လက်ဗွေ မရတဲ့ အမကြီး၊ကံကောင်းလို့ အဖိုး၊ အဖွား ကောင်တာ မသွားရတော့တာ၊ စာရွက်ကို စစ်၊ အမှားပါရင် ပြန်ဝင်ပြီးပြော၊ ပြီးရင် လက်မှတ်ထိုး၊ ပြန်လို့ ရပြီ ဆိုတော့မှ ဝမ်းသာပျော်ရွှင်ရပါတော့တယ်

Crd : Rupar Aye Naing ;

30.3.2023

29 ရက် မနေ့ကတုန်းက သွားလုပ်တာလေး ပြောပြခြင်လို့ပါခဗျ

အဓိကတော့ ကျနော့်လို မိဘက သန်ခေါင်စာရင်းမှာ

ဝန်ထမ်း ဖစ်နေလို့ စိုးရိမ်ကြတဲ့အကိုအမတွေအတွက်ပါ

နောက်ပီး PJ ကနေ PV ပဲဖစ်ဖစ် PVကနေ PJပဲဖစ်ဖစ်(အသစ်လုပ်သူများသာ) Qr letterမှာ မှာရေးရင်တောင် ကိုယ်ရေးအချက်အလက်မှနိအောင်သာရေးပါခဗျ အဆင်ပြေပါတယ်

မိဘက ဝန်ထမ်းဆိုရင် ကိုယ်ရေးအချက်အလက်မှာ

ဝန်ထမ်း လို့ပဲရေးပါခဗျ (အကယ်လို့ သန်ခေါင်စာရင်းမှာ ဝန်ထမိးဆိုပေမယ့် အပြင်မှာ အစိုးရဝန်ထမ်းဆိုရင်တောင် အစိုးရနဲ့ မသက်ဆိုင်တဲ့ ဝန်ထမ်းတစ်ခုခု မေးရင်ဖြေပါခဗျ မဟူတ်ရင် ရစ်တာနဲ့တင် တစ်နေကုန်နိုင်ပါတယ်ခဗျ)

Qr letter ကို ဖစ်နိုင်ရင် အပြည့်အစုံ ကူးသွားပါဗျ

စာရွက်နှစ်ရွက်ကို ကြောကပ်မကူးသွားပါနဲ့ ရစ်ခံရပါလိမိ့မယ်( ကျနောိ့တုန်းကတော့ ဓာတ်ပုံရိုက်တဲ့ counter 29မှာ တန်းစီတာ အဲ့ကရဲတွေက ဘာမှတော်ရုံမစစိဘူးဗျ ကံကောင်းတယ်လို့ပြောရမယ်ခဗျ) တစ်ချို့ counterတွေ အသေရစ် ငွေဆောင်ရတာတွေရှိတယ်ခဗျ ကို့ယ့်ဘက်ကပြည့်စုံအောင်လုပ်သွားပါခဗျ

အိမ်ထောင်စုမှာ ဖျက်ရာပါရင် ပြန်လွှတ်ပါတယ်ခဗျ![]()

သေးသေးလေးကအစ ပိုက်ဆံတောင်းပါတယိ ဖစ်နိုင်ရင် error မရှိအောင် ပြင်ဆင်သွားပါခဗျ ( ပိုက်ဆံအပို ယူသွားပါ ) မသိတာရှိရင် အတတ်နိုင်ဆုံး ကူညီပေးပေါ့မယ်ခဗျ အဆင်ပြေကြပါစေ

Crd: La Pyae ;

28.3.2023

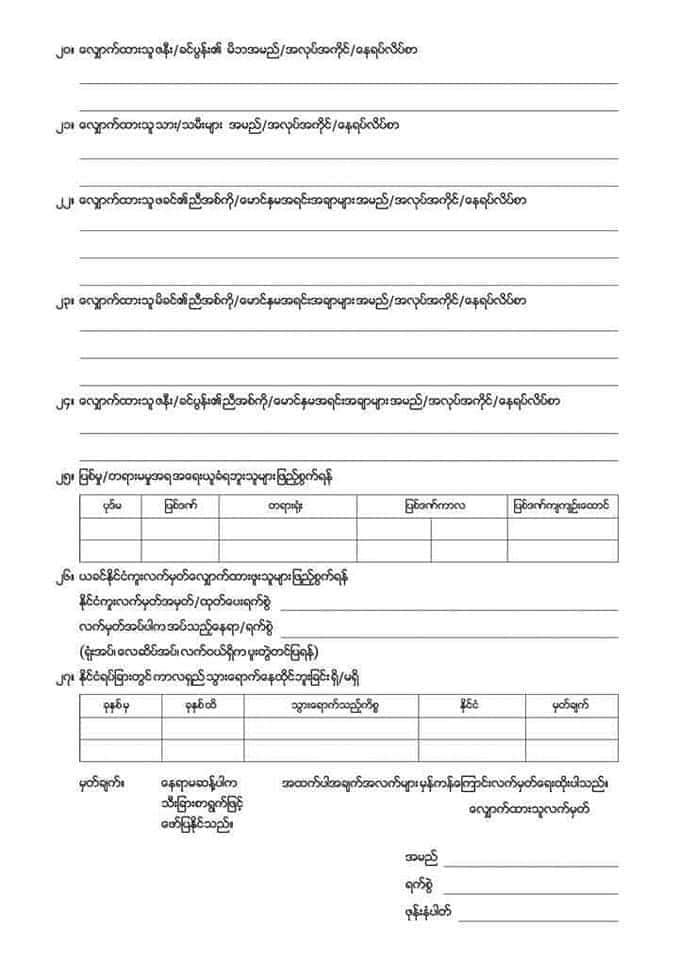

Passport online booking ဝင်လို့ အချိန်ကြာရင် session expired ဖြစ်တတ်လို့ မဖြစ်ရအောင်

- online မဝင်ခင် စာရွက်တစ်ရွက်မှာ

– လျှောက်ထားသည့်အမျိုးအစား (အသစ်/သက်တမ်းတိုး/အပျောက်)

– လျှောက်ထားမဲ့နိုင်ငံကူးလက်မှတ်အမျိုးအစား (အလည်/အလုပ်/ကျောင်းတက်/သင်္ဘောသား)

– အမည် (မြန်မာ+အင်္ဂလိပ်)

– အဖအမည်၊ အမိအမည်

– မွေးသက္ကရာဇ်

– မွေးရပ် (ရန်ကုန်/မန္တလေးစည်ပင်နယ်နမိတ်ထဲဲကမြို့နယ်များမှ အပမွေးစာရင်းထဲကမွေးသည့်မြို့နယ်

– နိုင်ငံသားကတ်အမှတ်

– နေရပ်၊ တိုင်း/ပြည်နယ်၊ အိမ်အမှတ်၊ လမ်းအမည် (ရှိလျှင်) ရပ်ကွက်/ကျေးရွာ၊ မြို့နယ်

– ဖုန်းနံပါတ်

– Email လိပ်စာ (ရှိလျှင်)

– ထင်ရှားသည့်အမှတ်အသား၊အရပ်အမြင့်၊မျက်လုံးအရောင်၊ ဆံပင်အရောင်

– လူမျိုး/ ဘာသာ

– ပညာအရည်အချင်း

– လက်ရှိအလုပ်အကိုင်

– သွားရောက်သည့်ကိစ္စ (အလည်/အလုပ်/ကျောင်းတက် စသည်)

– သွားရောက်မည့်နိုင်ငံ

– ယခင်နိုင်ငံကူးလက်မှတ်အမှတ်/ထုတ်ပေးသည့်နေ့စွဲ။ - ဝင်ပြီး ပထမစာမျက်နှာဖြညိ့ပြီးရင် တခြားအချက်အလက်များဖြညိ့ရနိ အစိမ်းရောင် Next ကိုမနှိပ်ပဲ အပြာရောင် Add to list ကိုနှိပ်ပြီးဆက်သွားပါ။

- Review and submit ကိုနှိပ်။ အမှားပါရင် edit နဲ့ပြငိပါ။ မှန်ရင် submit နှိပ်ပါ။ ငွေသွင်းဖို့ကျလာရင်ငွေသွင်းရုံပဲ။

Crd : Myanmar Pyithar;

Gaya အထွက်နဲ့ Passport လုပ်ပေးနေတဲ့ Travels Agents တွေရဲ့ feeling

- မပဒါမြေလူး

- ဒေါသစူး

- ရူးလိမ့်ငှာပြူး

- အကြောင်းထူး

- ထူးကြောင်းမလာ

- ရင်မောစွာ

- သောကဗြာဝေ

- တို့အဖြစ်တွေ myanmarvisa

Passport Application Form

မန်းလေး token ရပြီးသားတွေပြန်တန်းစရာမလိုပါဘူးနော် ဒီနေ့မှတွေ့ခဲ့လိူ့ပြန်တင်ပေးတာပါ

၂၄ရက်နေ့တစ်ရက်ဖွင့်လိုက်တာ လူပေါင်း ၈၅၀၀ ကျော်ဘယ်လိုတင်သွားတယ်မသိပေမဲ့ အဲလူတွေကိုတစ်ရက် အယောက် ၂၀၀ နှုန်းနဲ့လုပ်ပေးရင်တောင်ရက်ပေါင်း ၅၀ လောက်ကြာမယ်၊ နောက် ၂ လခွဲလောက်က appointment မရနိုင်တော့ဘူး၊ Thazin

24.3.2023

ဒီနေ့ 24.3.2023 ရက်နေ့

အတွေ့အကြုံလေး

shareချင်ပါတယ်ဗျ အမှားပြင်မယ့်သူတွေအတွက်ပါဗျ

ကျွန်တော်တော့အမှားပြင်တာ5ထောင်နဲ့စာရွက်မိတ္တူဖိုး3000 ပေါင်း 8000ပဲကုန်ပါတယ်ဗျ..

လိပ်စာ အိမ်နံပတ် မှားရင်ပြင်စရာမလိုပါဘူးဗျ

အပြင်မှာတန်းစီတာနှစ်မျိူးရှိပါတယ်ဗျ တစ်ဖက်က စာအုပ်လာထုတ်တာပါ. နောက်တစ်ဖက်က အသစ်လုပ်မယ့်သူတွေပါဗျ ထိုင်ခုံတွေကို အတင်းထိုင်ခိုင်းပါလိမ့်မယ် ထိုင်ရင်1000ပါဗျ ဝင်လို့ရပီဆိုတာနဲ့ အကုန်လုံးတစ်ခါထဲ ဝင်ရတာပါဗျ ရုံးထဲမဝင်ခင်ထိ အပြင်ကတန်းအဆင့်ဆင့်က အကုန်အတူတူဝင်ရတာပါဗျ..ရုံးထဲကို စာရွက်ဖိုင်. Ph. ပိုက်ဆံက လွဲ ပြီးကျန်တာ ယူလို့မရပါဘူးဗျ

ရုံးထဲရောက်ရင် တန်းကနှစ်ခါစီရပါတယ်ဗျ

ရုံးထဲရောက်ရင် တန်းမစီခင် ရဲအရာရှိတွေရှိပါတယ် အဲ့မှာအမှားမပြင်ကြပါနဲ့ ပြင်ရင်5ထောင်ပေးရပါတယ်

ပထဆုံးစစတွေ့တွေ့ခြင်း ကောင်တာတွေမှာတန်းစီရင် တော်တော်များများက ပိုက်ဆံမပေးရဘူးဆိုပေမယ့် တစ်ချိူ့လူတွေနဲ့ အမှားရှိတဲ့သူတွေကို 5000တောင်းပါတယ်ဗျ အမှားကို အထဲက ဓာတ်ပုံရိုက်ပေးတဲ့ကောင်တာတွေရဲ့ဘေးက ဝင်ဝင်ခြင်း ကောင်တာကအမှားပြင်ကောင်တာပါအဲ့မှာပြင်လို့ရပါတယ်ဗျ ပိုက်ဆံမပေးရဘူးဆိုပေမယ့် တစ်ချိူ့ကိုတော့ 5000တောင်းပါတယ်ဗျ..

အမှားပြင်ကောင်တာမှာ အမှားမပြင်ပဲ ဓာတ်ပုံရိုက် slipပေးတဲ့ ကောင်တာရောက်မှအမှား ပြင်ရင်5000 တောင်းပီးပြင်ပေးပါတယ်ဗျ..မိမိကိုယ်ရေးရာဇဝင်စာရွက်ကို အကုန်ဖြည့်ပါဗျ မရှိရင် မရှိဖြည့်ပြီး

အခြားအမည်ကိုမဖြည့်ပါနဲ့ဗျ no လဲ မရေးပါနဲ့ဗျ.. တက်ခဲ့တဲ့မူလတန်းကနေ အထက်တန်းထိ ဖြည့်ပါဗျ

အပြည့်စုံမဖြည့်ရင် ကိုယ့်အလှည့် ရောက်ရင် ပြန်ဖြည့်ပြီး တန်းပြန်စီရပါတယ်ဗျ

အားလုံးမှန်သွားမှ slip ထုတ်ပေးတာပါဗျ ကို့အချက်အလက်တွေမှန် မ မှန်စစ် ပြီး မှန်ရင် ပြန်လို့ရပါပီ ဗျ..

Crd : Moe Htet ;

22.3.2023

Buddha Gaya သွားမည့်သူများ Passport နေပြည်တော်တွင် ပြုလုပ်ပုံအဆင့်ဆင့်

- Passportစာအုပ်တွက်စလစ် ကိုယ်ရဲ့တစ်ကိုယ်ရည်သယ်ဆောင်နိုင်တာဘဲယူပါ အပိုလိုမယူပါနဲ့

- ၂၀၀တန်တဲ့ပစ္စည်းက၂၀၀၀ရှိပါတယ်၅၀၀တန်တဲ့ပစ္စည်းက၂၀၀၀တန်ပါတယ် ဒါကြောင့် အရင်ခြွေတာပါ😁

- ရောက်ရောက်ခြင်း ခုံလေးတေစီထားတာတွေ့ပါလိမ့်မယ် ထိုင်ရင်၁၀၀၀တောင်းပါတယ် ထိုင်သည်ဖြစ်စေမထိုင်သည်ဖြစ်စေ တန်းစီပြီးတူတူဝင်ရမှာပါ….😊

- ဝင်ပေါက်ရောက်ရင် မှတ်ပုံတင်မူရင်း QR တစ်ဆောင်တောင်းပါတယ်..သူတို့ကြည့်ပြီးပြန်ပေးပါတယ် pressure မပိပါနဲ့…အထဲရောက်ပြီ အထဲရောက်ရင် Pj Pv ခွဲထားပါတယ်…

- Counter 5ကPjပါ မရစ်ပါ မြန်တယ် မှန်တယ် သန်းခေါင်စရင်း မူရင်း မိတ္တူ မှတ်ပုံတင် မူရင်း ၂စောင်စီပေးရပါတယ်…အဲ့မှာပြီးရင် နောက်မှာ Pjလို့ပြထားတဲ့နေရာမှာတန်းစီပါ..

- ကျနော်ကတော့ဒီနေ့ counter26မှာစီပါတယ်… ဆင်ပြေတယ်မြန်တယ် မရစ်ပါ.. စလစ်ရခဲ့ပါတယ်… မှတ်ချက် ပိုက်ဆံ ၂၀၀၀၀ အထက်ဆောင်သွားပါ

Passport ရုံး သို့ သွားသည့် လမ်းညွှန်

- နေပြည်တော်အဝင်စစ်ဆေးပါမယ်

- ကုမ္ပဏီနာမည်နဲ့ Name list ဘုရားဖူးတွေရဲ့ မှတ်ပုံတင်တောင်းပါတယ်

- Name list ပေးခဲ့ရပါတယ်

- အဲ့ဒါပြီး တောက်လျှောက်မောင်း

- ပထမအဝိုင်းက ကံကော်အဝိုင်း တည့်တည့်မောင်း T ပုံသဏ္ဍန်လမ်းတွေမည် ဘယ်ဘက်ကွေ့တောက်လျှောက်မောင်း (ပြန်ကပြေး) ရပ်ကွက်မှ

- ဒုတိယအဝိုင်းက (ဇီဇဝါ) အဝိုင်း တောက်လျှေက်တည့်တည့်မောင်း နေပြည်တော်ကောင်စီလမ်းမကြီးဘေး ညာဘက်အခြမ်း နေပြည်တော် pp ရုံးရှိပါသည်ခင်ဗျာ

- Pp နဲ့မျက်နှာချင်းဆိုင် ဆောက်လုပ်ရေးဝန်ကြီးဌါနရုံးရှိပါသည်ဗျို့

နေပြည်တော်တွင် တည်းခိုလို့ရမဲ့ ကျွန်တော်တို့ အခန်းပုံလေးတွေ ရိုက်ပြတာပါဗျ

09-775 204 020 သို့ ဆက်သွယ်စုံစမ်းနိုင်ပါသည်

21.3.2023

“Buddha Gaya ဘုရားဖူး Passport အတွက် နေပြည်တော်တွင် ပြုလုပ်လို့ရပါပြီ”

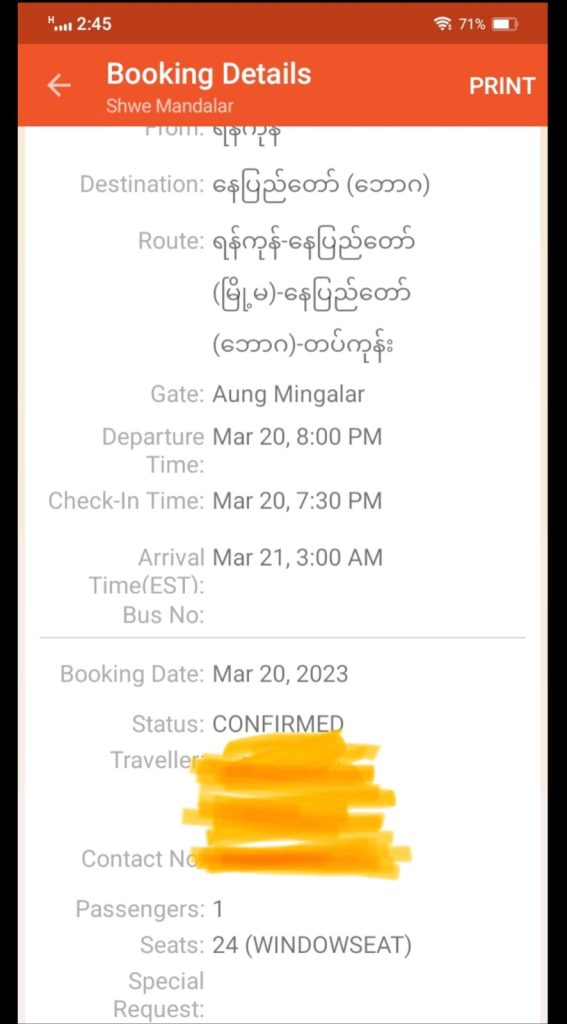

20.3.2023

ခုဆို Online Booking တင်ဖို့အတွက်လွယ်ကူလာပါပီ စပေးတုန်းကလိုတင်ဖို့မခက်တော့ပါဘူး အချိန်နည်းနည်းလေးပေးပီတင်ရင်ကိုရနေတာမလို့ ကိုယ်တိုင်ကြိုစားပီတင်ကျပါ

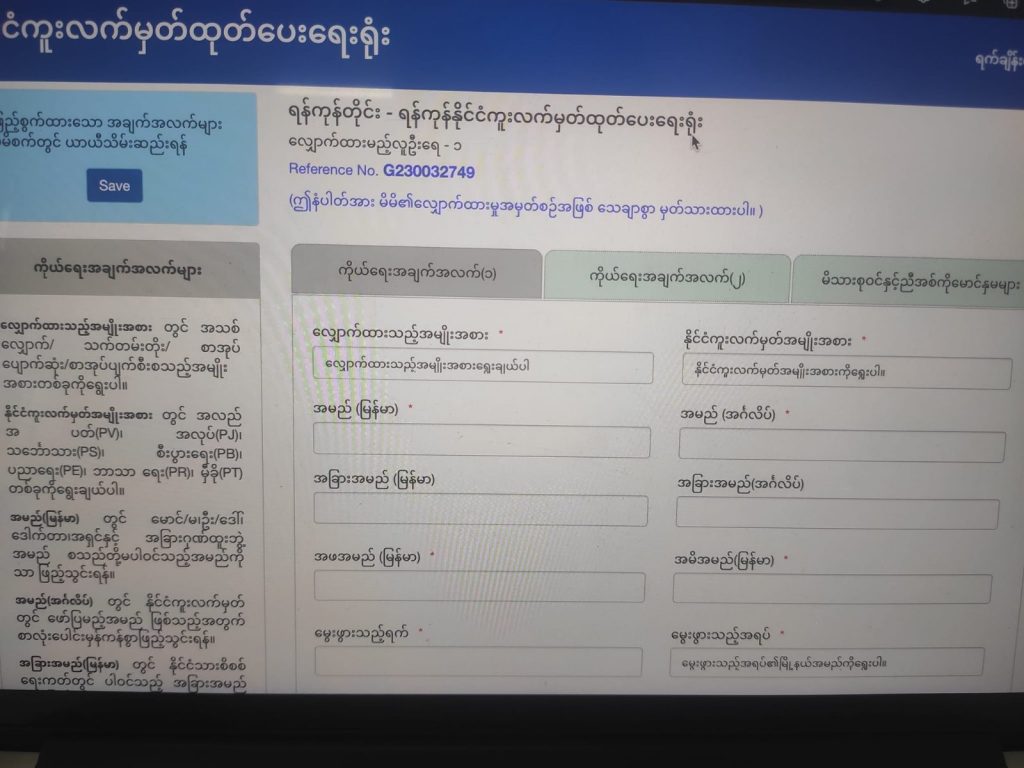

ခုမှစပီအသစ်တင်မယ့်သူတွေက online booking တင်နည်း အထဲရောက်ရင်ဖောင်ဘယ်လိုဖြည့်ရမလဲဆိုတာ မတင်ခင်သေချာလေ့လာပီမှတင်စေချင်တယ် မလေ့လာပဲတင်ရင်အထဲရောက်မှ ဖြည့်မတတ် အရေးကြီးဖြည့်ရမှာတွေမှားဖြည့်ခဲ့ရင် ရုံးရောက်တဲ့အခါပြန်ပြင်ရနဲ့ဆိုပိုပီအလုပ်များပါမယ် ဒဏ်ငွေဆိုပီလဲပေးနေရပါမယ် ပြန်ပြင်လို့မရဘူး အစကနေ Booking ပြန်ယူပီလုပ်မှရမယ်ဆိုရင်သွင်းထားတဲ့ငွေလဲဆုံး Booking ရက်လဲ အရမ်းဝေးသွားပါလိမ့်မယ် ဒါကြောင့် Online ဖောင်တင်တဲ့အခါ အချက်လက်တွေမမှားရအောင်သေချာဂရုစိုက်ပီတင်ကျပါ

ဖောင်တင်တဲ့နေရာမှာ အရေးကြီးတဲ့အချက်တွေက

နာမည် – မြန်မာ ( English အရေးကြီး ) မောင် မ ဦး ဒေါ် ထည့်စရာမလို

အဖအမည် –

မွေးသက္ကရာဇ် –

မှတ်ပုံတင်အမှတ် –

မွေးဖွားရာဒေသ –

ကျား / မ

နာမည် English မွေးသက္ကရာဇ် ကျား / မ သည် Passport စာအုပ်ထဲမှာပါသည့်အရေးကြီးအကြောင်းရာဖြစ်လို့မမှားအောင်သေချာဂရုစိုက်ပီဖြည့်ပေးပါ

အဖအမည် မှတ်ပုံတင်အမှတ် ကတော့ Booking စစ်တဲ့နေရာမှာ အရေးကြီးလို့ အဲ့ဒီနှစ်ခုကိုလည်းမမှားအောင်သေချာဖြည့်ပါ

အပေါ်ကအချက်တွေနည်းနည်းမှားရင် လဝကကောင်တာမှာတန်းမစီခင် အမှားပြင်ကောင်တာမှာအရင်မေးကြည့်ပါ ပြင်ဖို့လိုအပ်ရင်တစ်ခါတည်းပြင်လိုက်ပါပြင်ဖို့မလိုရင် လဝက ကောင်တာမှာတန်းစီလို့ရပါပီ ပြင်ရင်

Qr Code Print ထုတ်ထားတဲ့စာမျက်နှာ

အိမ်ထောင်စုစာရင်း + မှတ်ပုံတင် မိတ္တူ ၁ စောင်ပေးရတယ်

တစ်ချို့အချက်လက်တွေက ပြင်လို့ရပေမယ့် အရမ်းမှားနေတာမျိုးဆိုပြင်မရတတ်တာတွေရှိလို့ ဖောင်ဖြည့်ထဲကဒီအချက်လက်တွေကိုသေချာစစ်ပီးမှ Submit လုပ်ပါ

ဖောင်ဖြည့်တဲ့အချိန် အကိုယ်ရေးအချက်လက်တွေဖြည့်တဲ့အခါ ဒုတိယပုံမှာပါတဲ့ အရေးကြီးအချက်လက် ၁၂ ခု ဖောင်ထဲမှာလဲ Star အနီရောင်ပြထားတာတွေ အဓိကဖြည့်ပါ ကျန်တဲ့အချက်လက်တွေက ကိုယ်ရေးမှတ်တမ်းထိန်းသိမ်းရန်ပုံစံ ဖောင်ထဲမှာ အပြည့်စုံဖြည့်လိုက်ရင်ရပါတယ် အပေါ်ကအရေးကြီးအချက်လက် မဟုတ်ပဲကျန်တာတွေက online ဖောင်တင်တဲ့အချိန် ဖြည့်ထားတာမှားနေတာမျိုးရှိရင် ကိုယ်ရေးအချက်လက်ဖောင်မှာတာ အမှန် ပြည့်စုံအောင်ရေးပီဖြည့်လိုက်လို့ရပါတယ်

အတတ်နိုင်ဆုံးတော့ အချက်လက်တွေမမှားအောင်သေချာစစ်ဆေးပီးမှတင်ကျပါလို့ ……………

Crd : Thar Latt ;

15.3.2023

ရန်ကုန်ရုံးပါ။ ၃ကြိမ်မြောက်QR ယူပြီးမှ ဝင်ခဲ့တာပါ။ ပထမအကြိမ် ၃လစောင့်ပြီး ကျန်းမာရေးကြောင့်ဆေးရံုရောက်နေလို့မဝင်ဖြစ်ခဲ့ပါ။ ဒုတိယမကြိမ် QR ယူ ၃လစောင့်ပြီး ရံုးပိတ်သွားပါတယ်။ ဒါတတိယအကြိမ်ယူပြီးမှလုပ်ခဲ့တာပါ။

ပွဲစားတေကသူတို့ခုန်ငှါးရအောင်မျိုးစံုပြောပါလိမ့်မယ်။ ကိုယ်ကတော့ ၆နာရီကနေ၁၀နာရီထိ လံုးဝမထိုင်ပဲ လုပ်စရာရှိတာလုပ်ခဲ့ပါတယ်။

Crd : Alice Lwin ;

14.3.2023

ကိုယ့်ကိုကိုယ် သွေးနှောလား၊ မနှောလား ဇဝေဇဝါဖြစ်နေသူတွေအတွက်ပါ။

အဲ့အတွက်ကြောင့် မိမိဟာ ဘယ်အမျိုးအစားထဲပါလဲ? ဘယ်မှာစီရမလဲ၊ ဘာကိုးကွယ်လဲဆိုတာ ကွဲကွဲပြားပြားသိမယ်လို့ထင်ပါတယ်။ အားလုံးအဆင်ပြေပြေနဲ့ slip ရကြပါစေ။

crd : Ye Min Aung ;

13.3.2023

8.3.2023

နိုင်ငံကူးလက်မှတ်လျှောက်ထားဖို့ ရက်ချိန်းရယူသူများအနေဖြင့် ယခု Online က ဖြည့်တဲ့ အချက်အလက်တွေက လက်ဗွေနှိပ်တဲ့စနစ်အထိ ချိတ်ထားတာပါ။

ဂိတ်အဝင်အတွက်ဘဲ အသုံးပြုတာမဟုတ်ပါဘူး။

နိုင်ငံကူးလက်မှတ်လျှောက်ထားသူ ကာယကံရှင်အမည်မှာတော့ ကို၊ မ၊ ဦီး၊ ဒေါ် ကို မြန်မာလိုရော၊ အင်္ဂလိပ်လိုရော လုံးဝ မထည့်ပါနဲ့ခင်ဗျာ။

Crd : Thurein Htun ;

7.3.2023

ဒီနေ့ slip သွားယူတဲ့အတွေ့အကြုံလေး မျှဝေပေးချင်လို့ပါ

8-10 အချိန်ရတဲ့သူက အတော်လေးအဆင်ပြေပါတယ်

Appointment letter မှာပါတဲ့အချိန်တိုင်းပဲ ပေးဝင်တာမို့ အရမ်းအစောကြီး သွားစရာမလိုပါဘူး

သတ်မှတ်ထားတဲ့အချိန်ထက် တစ်နာရီလောက် စောရောက်ရင် အဆင်ပြေပါတယ် နေရာအရှေ့ဆုံးနားပိုရချင်ရင်တော့ အဲ့ထက်ပိုစောစောလေးသွားပါ

အမှားပါသွားရင် တောင်းပန်ပါတယ်ဗျ သိသလောက်လေး ပြန်ပြောပြပေးတာပါ အားလုံးလဲအဆင်ပြေကြပါစေ။

Crd : Khant thu;

3rd March, 2023

CB Visa ပြန်ရနေပါပြီ iBanking topup ရပြီးသုံးလို့ရပါပြီ။

1.3.2023 ရန်ကုန် Passport Online Booking များ Kpay က ငွေကို နူတ်ယူသွားပြီး Code မကျလာတာတွေဖြစ်နေတယ်လို့သိရပါတယ်

Crd:Min Min Myat;

28.2.2023

Gaya အထွက်နဲ့ Passport လုပ်ပေးနေတဲ့ Travels Agents တွေရဲ့ feeling

- မပဒါမြေလူး

- ဒေါသစူး

- ရူးလိမ့်ငှာပြူး

- အကြောင်းထူး

- ထူးကြောင်းမလာ

- ရင်မောစွာ

- သောကဗြာဝေ

- တို့အဖြစ်တွေ myanmarvisa

27.2.2023

ဒီတစ်ခါကတော့ Passport ရုံးကြီးကို ချီးမွမ်းမှာပါ စနစ်သစ်ကိုသဘောကျတယ်။ ခုလိုပဲ အမြဲစနစ်ကိုထိန်းထားနိုင်ပါစေ။

ဒီနေ့ စလစ်ရခဲ့တဲ့ သမီးလေး Saw Yu Hnin ပြောပြတာကို ပြန် Sharing လုပ်တာပါ။ကျေးဇူးတင်ပါတယ်သမီးရေ။

အချိန်နဲ့ပဲပေးဝင်ပါတယ်တဲ့။ကိုယ့်အချိန်ကိုယ်တော့ နည်းနည်းစောစောလေးအရောက်သွားလိုက်ပေါ့နော်။

QR code ပါတဲ့ Appointment က ၃စုံ အဝင်မှာတစ်စုံ

ကိုယ်ရေးအချက်အလက်ယူတဲ့ ကောင်တာ (ဓါတ်ပုံခန်းမှာ ၂စုံပေးရပါတယ်တဲ့)

ကိုယ်ရေးအချက်အလက်လက်ရေးနဲ့/Typing လုပ်သွားတာလည်း ၂စုံလောက်ယူသွားပါ။

Edit – ပိုတာက ကိစ္စမရှိလို့ ၃စုံသာလုပ်လိုက်။ တစ်စုံကိုအရင်ရေး လက်မှတ်မထိုးနဲ့နော် မိတ္တူကူးပြီးမှ ၃စုံလုံးမှာ လက်မှတ်ထိုးလိုက် ဒါဆို ကိုယ်သက်သာတယ်။

ကျန်တာကတော့ အရင်လိုပါပဲအရင်အတိုင်းပါပဲကွယ်။

အရင်ကအတိုင်းဆိုပေမယ့်မသိသူတွေအတွက်ထပ်ရေးပေးလိုက်ပါမယ်

QR စစ်ပြီးတာနဲ့ လဝက မှာ မှတ်ပုံတင် နဲ့ အိမ်ထောင်စုစာရင်းက မူရင်းရော မိတ္တူ ၂စုံရောပေးရတယ်။ မူရင်းကပြန်ပေးတယ်နော် သေချာပြန်ထည့်ယူခဲ့။

ဘဏ်တစ်ဆင့်လျော့သွားတော့ ပြီးတာနဲ့ ဓါတ်ပုံခန်းပဲ ဓါတ်ပုံခန်းမှာက မျက်လုံး Scan, လက်ဗွေ ဆယ်ချောင်းလုဲးယူတယ်၊ လက်မှတ်ထိုးရတယ်၊ ပုံရိုက်ရတယ်။ စလစ်ရလာလိမ့်မယ် သေချာစစ်ပါ မှားတာရှိရင် အားမနာနဲ့မကြောက်နဲ့ ဆရာရေ ဒါလေးတော့မှားနေလို့ပါ ဆိုပြီးပြောပါ။ နှုတ်ချို သျှိုတစ်ပါးပါ။

Facebook ပေါ်က ဂျင်းပို့စ်တွေ – စကားပြောချိုသူကပဲစိတ်ပုပ်သလိုပို့်စ်တွေကိုမယုံနဲ့နော်။ လူတွေအဓိက ဆက်ဆံရေးက စကားနဲ့ပဲပြောဆိုဆက်ဆံရတာမလား။ အန်တီဆို ကိုယ်ကြားချင်တာမျိုးပဲသူများကိုပြောတယ် ကိုယ်ရချင်တာမျိုးပဲသူများကိုပေးတယ်။ ကိုယ်မကြိုက်တာသူများကိုမလုပ်ဘူး (အနာဂမ်မဟုတ်သေးတော့တစ်ခါတစ်လေလည်း တစ်ဖက်လူကြောင့်စွာပြီး အမေဂျမ်း mood on ရတာတော့ရှိတတ်ပါတယ်) ။ ဒါက လူငယ်တွေအတွက် အကြံပြုချက်။

Credit – thinn thinn

24.2.2023

၂၄ရက်နေ့တစ်ရက်ဖွင့်လိုက်တာ လူပေါင်း ၈၅၀၀ ကျော်ဘယ်လိုတင်သွားတယ်မသိပေမဲ့ အဲလူတွေကိုတစ်ရက် အယောက် ၂၀၀ နှုန်းနဲ့လုပ်ပေးရင်တောင်ရက်ပေါင်း ၅၀ လောက်ကြာမယ်၊ နောက် ၂ လခွဲလောက်က appointment မရနိုင်တော့ဘူး၊ Thazin

မန်းလေး token ရပြီးသားတွေပြန်တန်းစရာမလိုပါဘူးနော် ဒီနေ့မှတွေ့ခဲ့လိူ့ပြန်တင်ပေးတာပါ

၂၄.၂.၂၀၂၃ မှစပြီး နိုင်ငံကူးလက်မှတ်လျှောက်ထားခ ကျပ် ၃၅၀၀၀ ဖြင့် ရက်ချိန်းသစ်ရယူနိုင်

ယခင် အွန်လိုင်းဖြင့် ရယူထားသော ရက်ချိန်းများ ပယ်ဖျက်လိုက်သောကြောင့် နိုင်ငံကူး လက်မှတ်လျှောက်ထားခကျပ် ၃၅၀၀၀ ဖြင့် ရက်ချိန်းအသစ်ရယူနိုင်ကြောင်း ဖေဖော်ဝါရီ ၂၃ ရက်က မြန်မာနိုင်ငံကူးလက်မှတ်ထုတ်ပေးရေးအဖွဲ့ရုံးမှ ထုတ်ပြန်သည်။ Daily Limit

အရင် QR စနစ်ထဲက Booking ကတော့ နောက်ကျမှရရင် ရက်ချိန်းကြာသွားနိုင်သလို တပတ်စာပဲဖွင့်ရင် Online Booking ပြည့်သွားတာမျိုးဖြစ်နိုင်ပါတယ်။

Ref No တွေ Kpay id တွေ အကုန် ဓာတ်ပုံရိုက်ထားပါ။

၂၄.၂.၂၀၂၃ မှစပြီး နိုင်ငံကူးလက်မှတ်လျှောက်ထားခ ကျပ် ၃၅၀၀၀ ဖြင့် ရက်ချိန်းသစ်ရယူနိုင်

ယခင် အွန်လိုင်းဖြင့် ရယူထားသော ရက်ချိန်းများ ပယ်ဖျက်လိုက်သောကြောင့် နိုင်ငံကူး လက်မှတ်လျှောက်ထားခကျပ် ၃၅၀၀၀ ဖြင့် ရက်ချိန်းအသစ်ရယူနိုင်ကြောင်း ဖေဖော်ဝါရီ ၂၃ ရက်က မြန်မာနိုင်ငံကူးလက်မှတ်ထုတ်ပေးရေးအဖွဲ့ရုံးမှ ထုတ်ပြန်သည်။

အဆိုပါ ထုတ်ပြန်ချက်တွင် မြန်မာနိုင်ငံကူးလက်မှတ်များ လျှောက်ထားခြင်းအတွက် Online Appointment System ဖြင့် ရက်ချိန်းရယူခြင်းကို ဖေဖော်ဝါရီ ၂၄ ရက်မှစတင်၍ www.passport.gov.mm ဝက်ဘ်ဆိုက်သို့ ဝင်ရောက်လျှောက်ထားနိုင်ကြောင်း၊ ရက်ချိန်းရယူရာတွင် နိုင်ငံကူးလက်မှတ်လျှောက်ထားခ ကျပ် ၃၅၀၀၀ ကို အွန်လိုင်းငွေပေးချေမှုစနစ်ဖြင့် တစ်ပါတည်း ပြုလုပ်ရမည်ဖြစ်ကြောင်း ဖော်ပြထားသည်။

ကိုယ်ရေးအချက်အလက်များဖြည့်စွက်ပြီးပါက ငွေပေးသွင်းရပါမည်။ ငွေပေးသွင်းခြင်းကို KBZ-Payဖြင့်သော်လည်းကောင်း၊ မြန်မာနိုင်ငံဘဏ်များအားလုံး၏ MPU ဘဏ်ကတ်ဖြင့်လည်းကောင်း ပေးချေနိုင်ပါသည်။ သို့ရာတွင် MPU ဘဏ်ကတ်သည် E-commerce အသုံးပြုရန်သက်ဆိုင်ရာဘဏ်တွင် လျှောက်ထားပြီးသည့် ဘဏ်ကတ်ဖြစ်ရပါမည်။ ပေးချေရာတွင် လျှောက်ထားသူတစ်ဦးချင်းစီ၏ Invoice No. ကို ရွေးချယ်၍ ငွေပေးချေမည့်စနစ်ကို ရွေးချယ်ပေးချေနိုင်ပါသည်။

ယခင် Online Booking စနစ်ဖြင့်ရယူထားသော ရက်ချိန်းများကို ပယ်ဖျက်လိုက်သည့်အတွက် Online Appointment System အသစ်ဖြင့် ရက်ချိန်းအသစ် ပြန်လည်ရယူရမည် ဖြစ်ကြောင်း အသိပေးထားသည်။

ထို့ပြင် Online Appointment စနစ်ဖြင့် ရက်ချိန်းရယူခြင်းဆိုင်ရာကြေညာချက်၊ Green Channel ဖြင့် လျှောက်ထားခြင်းအတွက် လမ်းညွှန်ချက်၊ Online Booking ပြုလုပ်ခြင်းလမ်းညွှန်တို့ကို www.passport.gov.mm ဝက်ဘ်ဆိုက်တွင် ဖတ်ရှုနိုင်ကြောင်း သိရသည်။

သတင်း – အလျင်း

Source: The Standard Time Daily

Passport Online booking

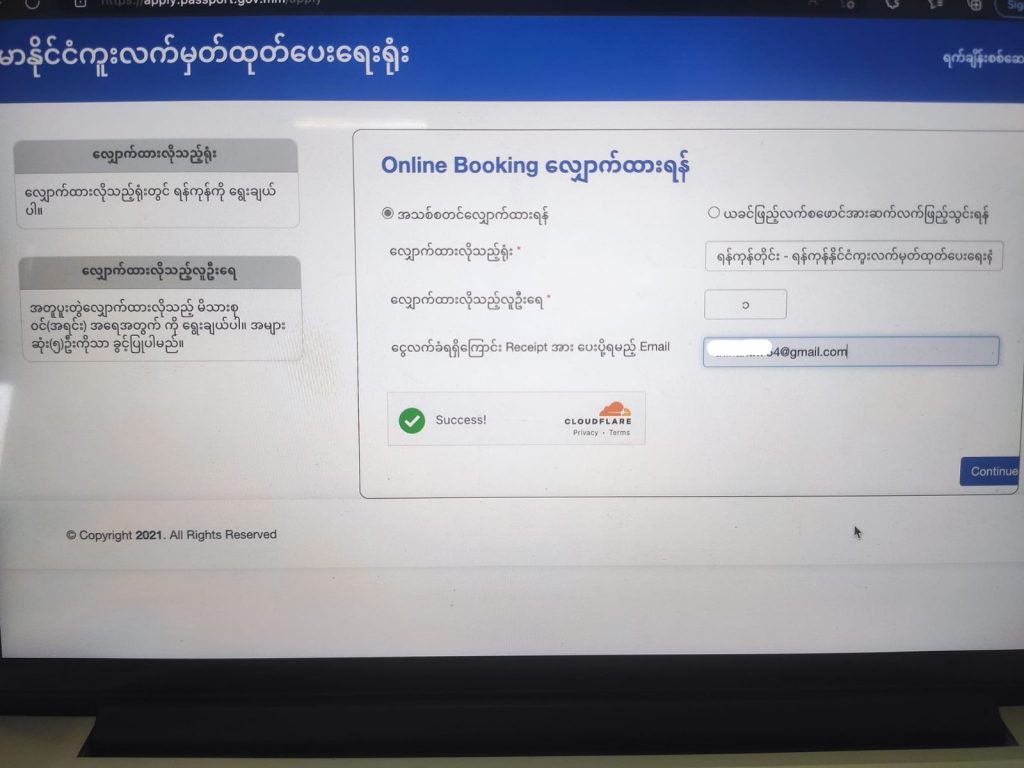

24 February 2023 – မှ စတင်၍ Passport ရုံးတွင် ဖြည့်ရမည့် Online booking တင်ရန်နည်းစနစ်လေးပါ ——————————————

Passport PJ/PV အသစ်လျှောက် / သက်တမ်းတိုးများအတွက်

( YANGON တစ်ခုတည်းအတွက်သာ )

* Passport စလုပ်ဖို့အတွက် ရုံးထဲကိုဝင်ခွင့် Online Booking လျှောက်ထားရန်လိုအပ်ပါတယ်

* Online Booking တင်ပုံတင်နည်းအကြောင်း Post အောက်ဆုံးမှာ Link ပေးထားပါတယ်

* Booking Appointments QR Code ရပီဆိုရင် QR Code မှာပါတဲ့ Date & Time မှာသွားပီ Passport စာအုပ်စလုပ်လို့ရပါပီ ကိုယ်ရထားတဲ့အချိန်ထက်နာရီဝက်ကြိုရောက်အောင်သွားပါ

* Booking QR Code ပုံကို Print (or) ဖုန်းထဲသိမ်းထားပြီးပြလို့ရပါတယ်

* Passport လုပ်ဖို့ လိုအပ်တဲ့ စာရွက်စာတမ်း တွေက အိမ်ထောင်စုစာရင်း မူရင်း + မိတ္တူ ၂ စောင် မှတ်ပုံတင် မူရင်း + မိတ္တူ ၂ စောင် ၁၀ နှစ်အောက်ကလေးများ မွေးစာရင်း မူရင်း + မိတ္တူ ၂ စောင် သက်တမ်းတိုးသမားတွေက စာအုပ်အဟောင်း + PP မှာ မိမိဓါတ်ပုံပါတဲ့စာမျက်နှာ မိတ္တူ ၂ စောင်

* PJ သမားတွေဆို Labour Card လိုပါယ၊ Labour Card ကနီးစပ်ရာမြို့နယ် အလုပ်သမားဦးစီးဌာနမှာ လျှောက်ထားလို့ရပါတယ် ၅၀၀ (သို့) ၁၀၀၀ ကျပ် * ရုံးထဲဝင်ဖို့အတွက်ဝင်ပေါက် ၃ နေရာ ( ပန်းခြံဘေး, ရန်ကင်း centerရှေ့, စက်မှု ၁ ) ဝင်လို့ရပါတယ်၊

(ဝင်ပေါက်မရောက်ခင်အပြင်မှာရှိတဲ့ပွဲစားတွေဘာပြောပြောနားမထောင်ပါနဲ့သူတို့ရိုက်စားခွင်လုပ်လို့ရအောင်တမင်ပြောနေတာမလို့ ဝင်ပေါက်နားမှာရှိတဲ့ ရဲတွေကိုမေးမြန်းပါ ကိုယ့်မှာပါတဲ့ Booking QR Code ကိုသူတို့ကိုပြလိုက်ရင် စစ်ပီးပေးဝင်ပါတယ်)

* ပထမဆုံးစစ်တဲ့ဂိတ်မှာ ဖုန်းထဲမှာအသင့် Save ထားတဲ့ ဓါတ်ပုံ (သို့) Print ထုတ်လာတဲ့ Booking Qr Code ထဲက ကိုယ်ရေးအချက်လက်နဲ့ မှတ်ပုံတင်ထဲကကိုယ်ရေးအချက်လက် စစ်ဆေးပီးရင်အထဲကိုဝင်လို့ရပါပီ

* ဒုတိယဂိတ်မှာ ပါလာတဲ့ QR Code မှတ်ပုံတင် မျက်နှာ Scan ဖတ် စစ်ဆေးပီးရင်ရုံးထဲကို ဝင်လို့ရပါပီ အထဲကို ဖုန်း စာရွက်စာတမ်းပါတဲ့ ဖိုင် နဲ့ ပိုက်ဆံအိတ်အသေးကလွှဲရင် ကျန်တာဘာမှပေးမယူပါဘူး ထီး ရေဘူး tissue ထုပ်ကအစအကုန်အပြင်မှာထားခဲ့ရတာ

* ရုံးထဲစဝင်တာနဲ့ အဝင်ဝလေးမှာရဲနှစ်ယောက်ထိုင်နေပီ အထဲမှာဖြည့်ရမယ် Form ပေးပါတယ် Form ခ ၁၀၀၀ ကျပ် တစ်ခါတစ်လေ Free

* Form ရပီဆိုရင် မဖြည့်ပါနဲ့အုံး လဝက ကောင်တာတွေမှာ အရင်ဆုံးယူလာတဲ့စာရွက်စာတမ်းတွေစစ်ဖို့တန်းစီပါ လူအရှင်းဆုံးအတန်းမှာစီပါမသေချာရင်အဲ့မှာရှိနေတဲ့ ဝန်ထမ်းတွေ ရဲတွေ ကိုမေးပါ သက်တန်းတိုးသမားတွေက Counter 1 မှာတန်းစီရပါတယ်

မှတ်ပုံတင်မှာ ကရင်+ဗမာ / ဗမာရှေ့မှာ (+) ဆိုရင်သွေးနှော လို့ဆိုပီ တစ်ခြားကောင်တာတစ်ခုမှာသီးသန့်စီရပါတယ် လဝက form စစ် ၂၀၀၀ ကျပ်ပါ သွေးနှောသမားတွေက ၂၀၀၀+ ၅၀၀၀ အားလုံးစစ်ပီးသွားရင် ခုနပေးထားတဲ့ မူရင်း+ စာရွက်စာတမ်းတစ်စုံရယ် ဘဏ်သွင်းဖို့ စာရွက်ပေးပါတယ်

* လဝကပေးတဲ့ ဘဏ်ငွေသွင်းဖို့စာရွက်နဲ့ အထဲမှာရှိတဲ့ ဘဏ်မှာ ၂၅၀၀၀ ပေးသွင်းပါ ဘဏ်ဘယ်နားရှိလဲမသိရင် အထဲကဝန်ထမ်းတွေ ရဲတွေကိုမေးပါ မကြောက်ပါနဲ့သူတို့ပြောပြတယ် ဘဏ်ငွေသွင်းပီရင် ငွေသွင်းပီးကြောင်း စာရွက်ပြန်ပေးပါတယ် အချိန်နည်းနည်းကြာတတ်လို့ ဝင်ဝင်ခြင်းမှာယူလာတဲ့ Form ကိုဖြည့်ပါ Form ဖြည့်နေတုန်း ဘဏ်ကကိုယ့်နာမည်ခေါ်တာကိုလဲ နားစွင့်ထားပါ ကိုယ့်နာမည်ခေါ်ပီဆို ဘဏ်ကပေးတဲ့ Slip စာရွက်ယူ ကိုယ့်နာမည် မှတ်ပုံတင်အမှတ် မှန်မမှန်ပြန်စစ်ပါ စစ်လို့မှန်ရင် ဓါတ်ပုံရိုက်ဖို့သွားပါ

* နောက်ဆုံးအဆင့် ဓါတ်ပုံရိုက်ဖို့တန်းစီပါ Counter 16 ကလွဲရင်ကျန်တဲ့ Counter လူအနည်းဆုံး Counter မှာတန်းစီပါ မိတ္တူတစ်စုံ ဖြည့်ထားတဲ့ Form ဘဏ်ငွေသွင်းပီးကြောင်း Slip သူတို့ကိုပေးပါ ဓါတ်ပုံရိုက် လက်ဗွေနှိပ် မျက်စိ Scan ဖတ် Tablet ပြားပေါ်မှာလက်မှတ်ထိုး အထဲမှာသူတို့မေးတာပြန်ဖြေ ပီးရင် ၅၀၀၀ သွင်း

* ဓါတ်ပုံရိုက်တဲ့အခန်းမှာ အရေးကြီးဆုံးက PJ သမားတွေပါ PV (သို့) PJ လို့မေးပါမယ် အလည်ပတ် PV သမားတွေက PV ဘဲပြောပါ အလုပ်နဲ့သွားမယ့်သူတွေက PJ လို့ပြောပါ Labour Card မလုပ်ရသေးဘူးဆိုရင် အဲ့ဒီနေရာမှာ Labour Card လုပ်ချင်ကြောင်းပြောလိုက်ပါ အပြင်ထက်ဈေးပိုများပါတယ် ၅၀၀၀ ပေးရမှာ အားလုံးပီးသွားရင် Passport စာအုပ်ထုတ်ဖို့ Slip ရပါပီ

* Slip ရရင် သေချာပြန်စစ်ပါ ကိုယ်ပေးထားတဲ့ ကိုယ်ရေးအချက်လက်တွေအားလုံး မှန်လား မှားလား နာမည် English စာလုံးပေါင်း မွေးသက္ကရာဇ် PV /PJ တွေကအရေးကြီးဆုံးပါ မှားနေရင်ပြန်ပြောပီ ပြင်ခိုင်းပါ အားလုံးမှန်တယ်ဆိုရင် Slip လေးယူပီအိမ်ပြန်လို့ရပါပီ

* နောက် ၁၀ ရက် ကြာရင် ရုံးသွားပီကိုယ့်ရဲ့ Passport စာအုပ်ထုတ်လို့ရပါပီ ထုတ်ရမယ့်နေ့က စနေ တနင်္ဂနွေ အစိုးရ ရုံးပိတ်များဆိုရင် ထုတ်မရပါဘူး ရုံးပိတ်ရက်ပီးနောက်နေ့ကစ ရက်ပေါင်း ၉၀ အတွင်း ထုတ်လို့ရပါတယ် စာအုပ်ထုတ်ရင်ပေးထားတဲ့ Slip နဲ့ ပြပီဝင်လို့ရပါတယ် တန်းစီစရာမလို Online Booking ထပ်ယူစရာမလိုပါဘူး သွား ထုတ်တဲ့အခါ Slip ရယ် မှတ်ပုံတင်မူရင်းရယ် ယူသွားပါ ၃၀၀၀ ကျပ်ပေးရ Passport စာအုပ်ရပါပီ ၊၊

ကုန်ကျငွေ Form – ၁၀၀၀ ကျပ် လဝက စစ် – ၂၀၀၀ ကျပ် ဘဏ်သွင်း – ၂၅၀၀၀ ကျပ် ဓါတ်ပုံရိုက် – ၅၀၀၀ ကျပ် စုစုပေါင်း = ၃၃၀၀၀ ကျပ် Online booking service

Credit : Nat Pen Gyi

Myanmar Visa helps a Brit with Business visa successfully. Another success story!

22.9.2022

“Myanmar Visa” successfully assisted Business Visa Online application for Mr. Alex, a British passport holder. To avoid any hassle or uncertainty, Mr. Alex sent an email to Myanmar Visa to apply for the online business visa. Myanmar Visa sent a letter to Mr.Alex and detailing the application Visa Procedure. Finally, Mr. Alex Visa was approved.

Mr. Charles Business Visa.

27.7.2022

Mr. Charles, a Canadian passport holder, applied the online eVisa directly but it was still under processing and had not received the Online Business Visa for more than ten days. Mr. Charles sent an email to “Myanmar Visa” to checked the status of the application and find the solution to overcome the difficult situation.

“Myanmar Visa” made a constant follow up phone call with the immigration department and found that the company that sponsored Mr. Charles did not meet the unwritted minimum amount of paid up capital. Therefore Myanmar Visa followed up with immigration department in both Yangon and Naypyitaw.

After several emails and phonecalls Mr. Charles Business Visa was approved on 19th July 2022. We appreciate Ms. Myat efforts in securing Mr. Charles Business Visa.